views

The Federal Reserve's decision to raise interest rates on an ongoing basis has had a significant impact on global financial markets, including the cryptocurrency market. The unpredictability of this impact (FED Interest Rate) has been a subject of concern for cryptocurrency investors and analysts.

In this piece of article, we'll look at why the US Federal Reserve is raising interest rates and how it's affecting the cryptocurrency market.

Interest rates are an important tool used by central banks to manage the economy. By raising interest rates, central banks aim to control inflation & encourage savings. This can lead to slower economic growth. Conversely, lowering interest rates can stimulate borrowing and spending, boosting economic activity.

The US Federal Reserve's decision to continuously hike interest rates in response to rising inflation has caused concern in the cryptocurrency market. Many investors worry that higher interest rates could lead to a drop in demand for cryptocurrencies. Since cryptocurrencies are often seen as an alternative to traditional assets like stocks and bonds.

Actually, in the current US economic scenario, inflation is at its peak level, somewhere around 6%. This prompted the US Federal Reserve to hike the interest rate. That will reduce demand for consumer goods and services by making borrowing more expensive.

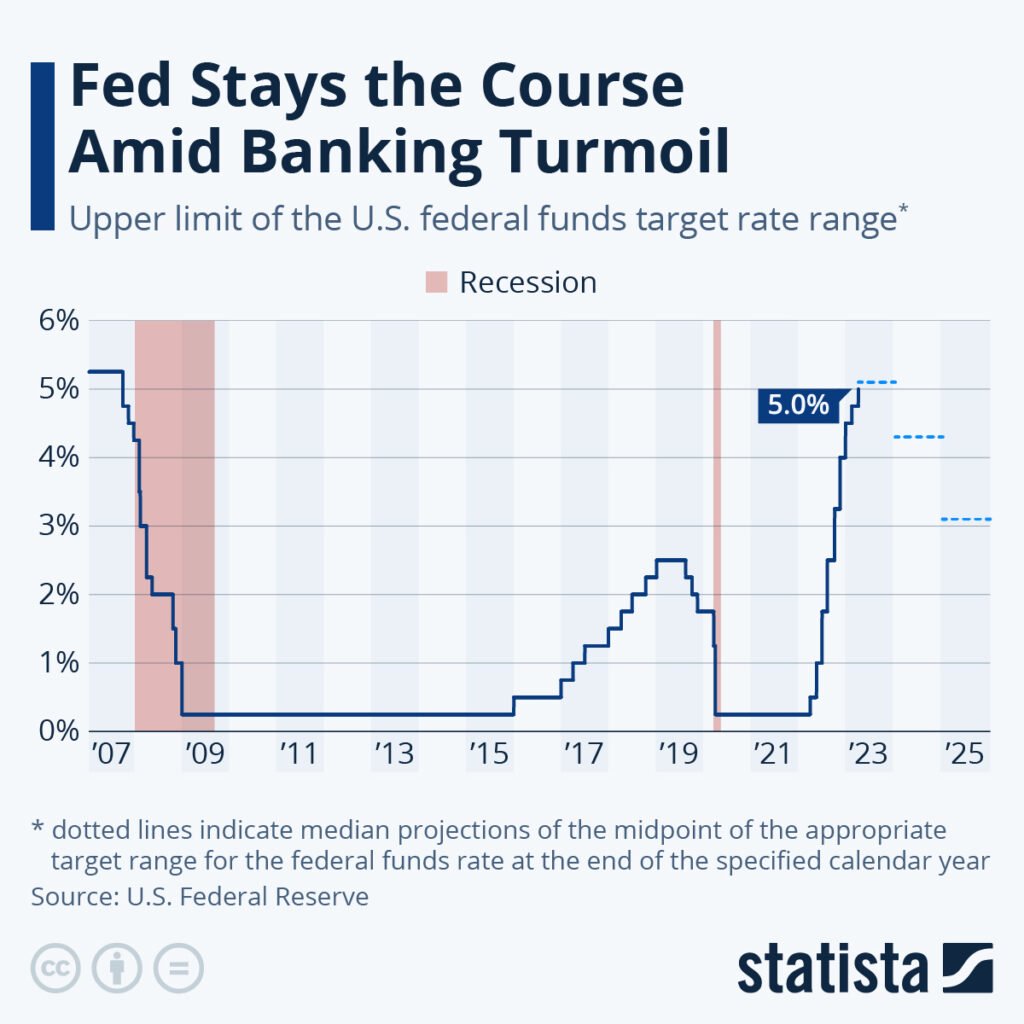

This indirectly helps the US economy in curbing the rising inflation. If we look at the chart of rising interest rates, the US FED started hiking interest rates in March 2022. And, till today, the FED continues to maintain its harsh stance toward rising interest rates.

As seen in the last FOMC meeting, FED chairman Jerome Powell asserted that “additional policy firming may be appropriate,” which indicates a weaker commitment to future hikes. This also shows that in the times to come, we may witness more hikes with a much harsher attitude.

When interest rates rise, the money supply & the Fed's balance sheet shrink. And the cost of consumer and business borrowing increases. As a result, when the money supply shrinks and price hikes are imposed on businesses and consumers, public company valuations fall. This forces their stocks to fall and leaves less disposable income for average people to invest.

This leads individuals to stop buying or even selling assets such as cryptocurrency and stocks. In exchange for fixed-income investments such as bonds. This is because when interest rates rise, the guaranteed return on government bonds rises. It leads investors to rush to risk-off assets such as bonds.

As a result, when interest rates rise, crypto prices fall. This ripple impact is fueled by slower economic activity, decreased corporate investment, and a bad macroeconomic background that is unfavorable to cryptocurrency.

This indicates that the impact of the US FED interest rate hike on the cryptocurrency market is quite robust. It may take some time for investors to adjust to the new economic environment. And assess the potential impact on cryptocurrencies.

The unpredictable nature of the cryptocurrency market makes it difficult to predict how it will react to the FED interest rate hike. While past performance may offer some guidance, it is important for investors to remain vigilant and closely monitor market developments.

The key is to be prepared for any potential impact and to have a solid strategy in place to mitigate risk and maximize returns.

To know more about the Unpredictable Impact of FED Interest Rate Hike on the Crypto Market, go check out SunCrypto Academy.

Your email address will not be published. Required fields are marked *

Name *

Email *

Website

Comment *

Save my name, email, and website in this browser for the next time I comment.